Maintaining your small business finances operating smoothly can typically become a problem in currently’s quickly-paced globe. Determined by your particular business requirements, a small business line of credit might be the simple Option you'll want to fulfill your plans for growth — in a pace that's good for you.

Just about any sort of business loan may be secured in case you give a method of collateral. Here i will discuss the commonest financing options that usually require collateral.

Collateral Paperwork:Â If making use of for a secured loan, supply documentation for your property you plan to work with as collateral.

Uniform Commercial Code lien. A UCC lien provides a lender the best to seize your business’s assets if you can’t repay your loan. A UCC lien is definitely an Formal document, normally filed Together with the applicable secretary of point out’s Office environment Once you’ve signed your loan settlement.

These lenders frequently take a “significant-picture approach” by taking a look at your business’s opportunity for development as an alternative to demanding robust credit scores. Having said that, you sometimes want to function for at least six months to qualify for startup financing.

The whole expense of a business line of credit will depend upon your desire level and any service fees. Unlike a business expression loan, even so, You simply spend desire about the dollars you draw.

Investigate and Review various options to find the most effective healthy to suit your needs. You’ll want to search for a lender whose prerequisites you'll be able to meet up with and one particular who gives the type of credit line you may need.

Business Lines of Credit: A line of credit presents flexibility, permitting you to definitely borrow approximately a specific Restrict and only spend fascination on the quantity you utilize. It’s specially useful for controlling hard cash movement fluctuations.

Equipment: Lenders commonly perspective equipment you need to invest in as collateral considering the fact that they could repossess it if you default to the loan.

Bank of The us presents secured business loans with aggressive rates and terms. You may secure your loan with business assets or certificates of deposit.

Quick attract intervals and repayment conditions. To limit their chance, the lender may possibly only provide you with a short-expression loan. Meaning they may only let you employ the line of credit for a short window. In addition, they may involve you to definitely repay what you made use of inside six to 18 months.

If you have a reduced credit rating, providing collateral could help minimize your danger to lenders. Additionally, equipment financing tends to simply accept reduced credit scores since the equipment functions as collateral.

Certain hyperlinks may possibly immediate you how do you get financing for a small business far from Bank of The us to unaffiliated sites. Bank of The united states has not been involved with the preparation of your material equipped at unaffiliated web pages and does not guarantee or suppose any responsibility for his or her material.

Is often slower to fund than unsecured loans, particularly if the lender involves an appraisal of the collateral.

Alisan Porter Then & Now!

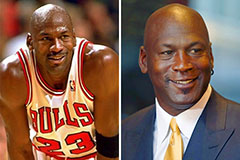

Alisan Porter Then & Now! Michael Jordan Then & Now!

Michael Jordan Then & Now! Pauley Perrette Then & Now!

Pauley Perrette Then & Now! Erika Eleniak Then & Now!

Erika Eleniak Then & Now! Nadia Bjorlin Then & Now!

Nadia Bjorlin Then & Now!